Whichever business you are involved with, you need to know how to distribute your finances in a smart way. Best budget dashboards will be shown to you in this article. Budget dashboard is a visual representation of your finances where you can track all your incomes, expenses, or savings, all in one place.

If you are a business owner, you need to calculate if there are enough funds for all your expenses, your employee’s salaries, and much more. Your whole business could experience a downfall if you do not pay attention to your finances properly. We do not want that to happen. Distributing finances before your projects is a crucial part of the process so having a good budget dashboard should be imperative for you.

Having a budget dashboard has its own pros and cons, but when using a good one, you can rest assured that your finances will be handled correctly.

Budget Dashboard Pros and Cons

Using a budget dashboard can be a very time-saving and useful option when you need to deal with the financial side of things. They are not only practical but also very reliable for your budget tracking. There are several benefits that your budget dashboard can give you:

- Budget dashboard saves you time

- It improves decision making

- It lets you see all the data in one place

- You can easily check balances and progress

- You can easily calculate your expenses and compare them to your incomes

Of course, there are some challenges that might occur, such as:

- Compatibility issues

- Setting up your dashboard without a specific user in mind

- Costs

- Selecting the wrong metrics

However, when you learn how to correctly use your budget dashboard and when you select the one that fits your needs, this could be the best part of your financial management job.

Best Budget Dashboards

In case you are wondering which budget dashboard is the best, there are several alternatives. This article will give you an insight into some of the best options.

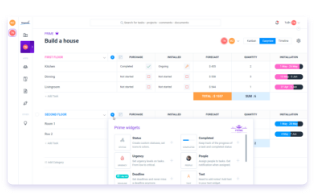

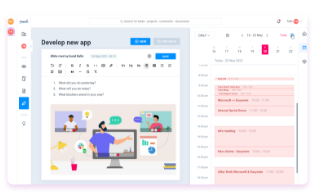

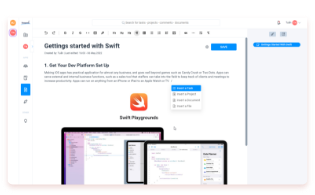

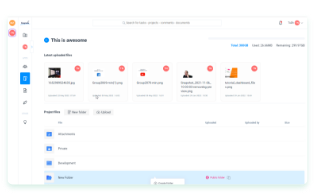

1. Easynote

Easynote offers you the Ultimate dashboard which gives you the best options when it comes to project, work, and budget management. It can be adapted to any industry and it can sync all your different projects into one overview.

This AI-powered tool gives you the experience of 5 tools in 1. It is an excellent time-saving and project management app. You can manage your budget by creating a personal dashboard and adding all financial data which will be one click away.

Also, you can tag all people involved in the projects or sync your timelines and calendars so you do not have to think about any financial expenses that you haven’t previously prepared for. This can help you organize your budget and financial plans which are important for any project you have.

2. Google Sheets or Microsoft Excel

When it comes to managing a budget dashboard, you can always rely on Microsoft Excel and Google Sheets. Microsoft Exel is a spreadsheet program that allows you to enter specific data (funds) and it automatically calculates whichever (finance) statistics you need to track.

Google Sheets works in a similar manner and it lets you see graphs and charts that represent all the financial data that are important to you.

There are many Google Sheets budget dashboard templates that you can find online and choose the one for your liking and needs.

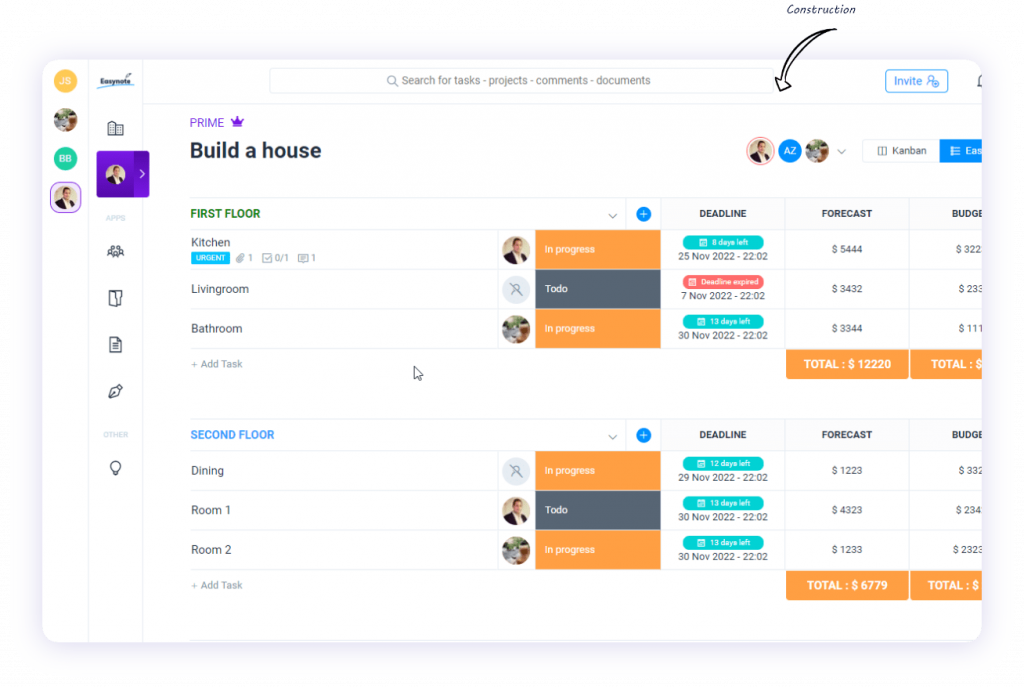

3. YNAB (You Need a Budget)

You Need a Budget is another budgeting software with the help of which you can create a personal budget dashboard.

It lets you connect to your bank, and securely link your bank accounts. It also offers safe transactions.

You can also use the Goal Tracking feature which gives you an insight into all of your expenses, financial goals, and how far or close you are from them. This is great for goal-oriented managers or teams because it can be hugely motivating for you.

Additionally, a Loan Planner tool calculates your interest for any amount of money you put toward your debt. YNAB makes it easy to categorize your budget and offers ultimate security.

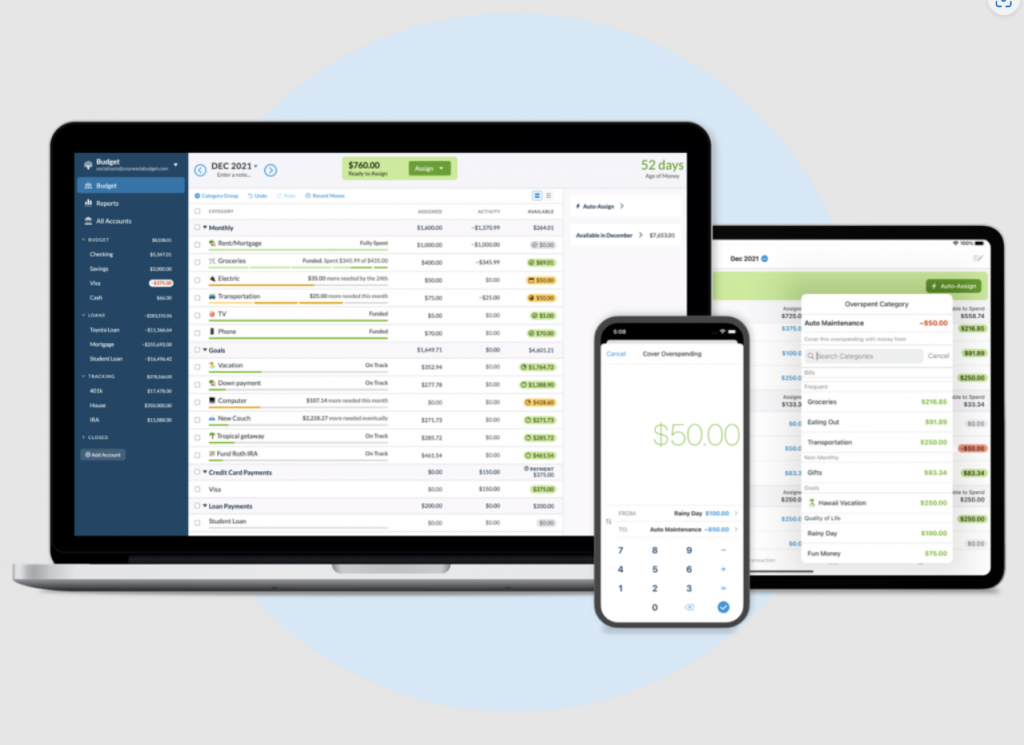

4. Mint

Mint is a free budgeting app that syncs your bank accounts and lets you have an insight into all your spending and income. You can use it for both your personal and company budgeting. This budget dashboard app has a visual representation of your finances which you can filter and customize based on your priority and needs.

If you want to track your spending daily or have a budget goal, Mint provides several features that can help you with that.

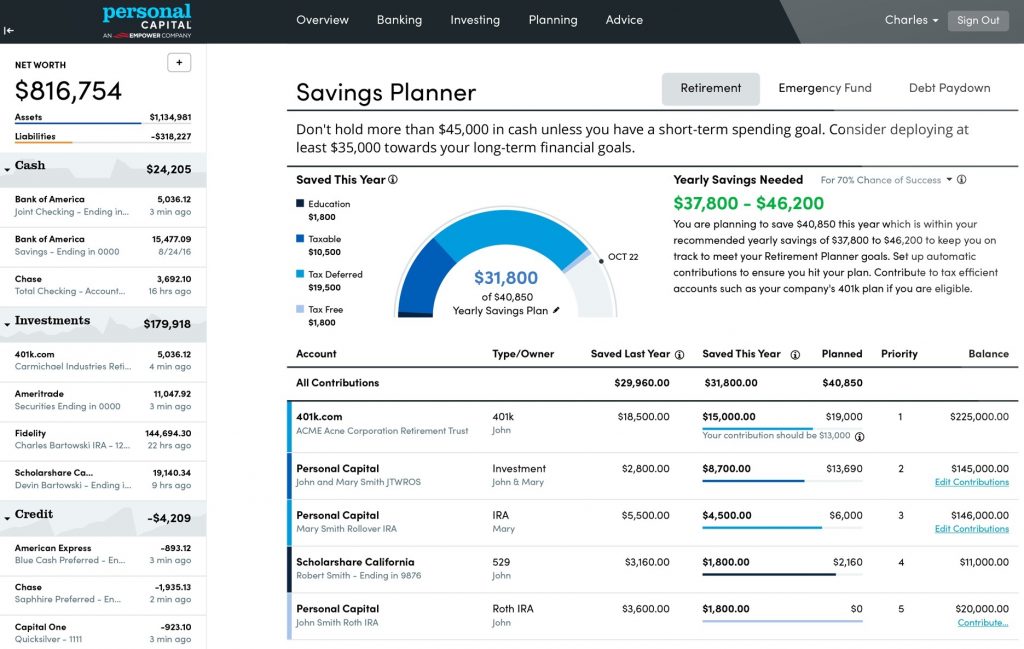

5. Personal Capital / Empower

Personal Capital is now Empower and it is also one of the best budget dashboard free apps out there. Your personal dashboard is secure and user-friendly. It shows all the data you need to calculate your personal or business budgets or to track your spending and losses.

It also gives you an option of a second opinion on your present investment strategy where you can talk to an advisor for free. Additionally, you can plan your retirement success and see what your retirement might look like.

There are other options such as Run Different Scenarios, which lets you see how your finances would look with potential what-ifs and you can make these new potential plans into your present plans if you see them as beneficial.

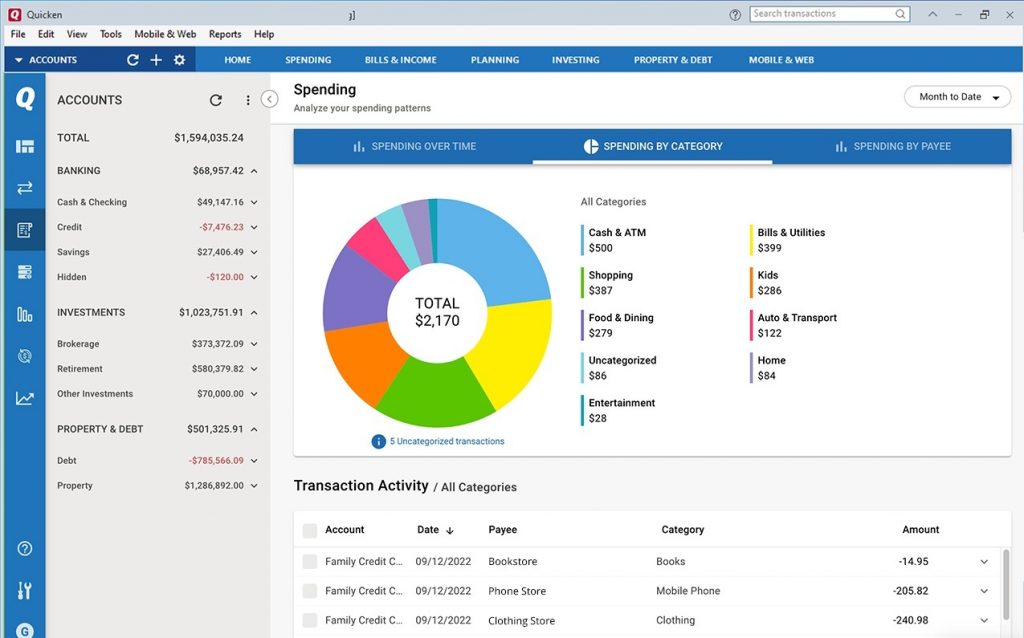

6. Quicken

Quicken provides a budget dashboard that helps you take control of finances. It is great for small businesses, property management, or retirement plans. You can plan a budget for any of your projects or personal demands.

When it comes to property management, there are features that are extremely helpful where you can track all things that are concerned with property value, loans, or expenses. Rental agreements, and move-in and move-out dates are also there on your dashboard. You can store your contracts and receipts inside this dashboard.

Quicken offers a 30-day risk-free plan where you can try out all the options and see how well you could manage your budget with this budget dashboard.

Significance of Financial Dashboards in Reporting

Having a well-organized budget dashboard lets you have confidence in a very sensitive part of your work- money. Nothing can properly work if your finances aren’t organized as they should be. If you are a finance expert, you will need to generate financial reports for the company you work at.

Financial reporting is important because it pretty much defines businesses’ success. Knowing that your company is doing well financially proves that your decisions and budget planning have been done correctly.

Also, when a team decides what the success of a certain project is, it gives the ultimate confidence boost when that goal is reached.

Additionally, you do not need to spend so much time figuring out how all the figures work and if they are correct. Financial dashboards give you a bird’s eye view of your progress and they calculate everything themselves.

Tips for Creating a Budget Dashboard

There are a few ways you can make your budget dashboard more accessible to you. You should customize it so it fits your needs and all the numbers do not confuse you. There are many tips and tricks on how you can create your dashboard so here are a few of them:

- Use colors

When you use colors to sort your budget slots, it is visually easier to know exactly what is your priority at the first glance. You can also color-coordinate different projects or your business and personal finances. Sometimes it is easier to know which payment needs to be done today if it is colored red which symbolizes urgency.

- Keep it simple

If you are creating a new budget dashboard, do not over-complicate things. Do not get lost in your own dashboard and create a dashboard that is not useful or productive for you. That is why the already mentioned apps are a good choice because they make it easier to navigate through your finances and they offer some very simple budget dashboard templates.

- Regular updates

Try to regularly update your dashboard in order to not get lost in your data. It is important to set your update or update it manually daily, weekly, or every two weeks. Businesses especially need to keep updating these dashboards regularly since every payment and all the incomes need to stay closely observed.

- Metrics matter

It is important to use metrics that your objectives need and that are most relevant. Your objectives need to be supported by everything on your dashboard so metrics must be relevant for you.

A Budget vs. Actual Dashboard

Every project needs to have an estimate of all the expenses and incomes that will be included in future plans. However, these estimates are not always correct as many things during the project implementation might change.

People may leave, you may need to hire new employees, some deadlines might not be possible due to some complications, etc. A budget vs. Actual dashboard is a tool that can help you visually compare your planned budgets with the actual amount spent on the project.

This is important because planned budgets may sometimes be very different from the actual expenses and you need to justify where the money went.

Budget dashboards may also be a crucial part of the project review procedure. When you know which project went above the given budget and why it is easier to plan the budget for future projects.

Future of Budget Dashboards

As more and more people work with digital ways of dealing with budgets and as technology develops, our need for an easier way of following our budgets grows.

It might be difficult to track every expense across all your projects, but the apps mentioned in this article will help you do it with just one click. Easynote, Mint, Empower, YNAB, and many other apps will help you deal with the overgrowing stress of budgeting.

These apps represent the future of budgeting since many businesses turn to mobile banking and virtual budget dashboards. Also, modern life does not let us spend hours calculating all our expenses and future budgets when they could be calculated just with one click using these apps and programs.

If you still like the old-school way of budgeting, although it can be very time-consuming, you may find these apps helpful when it comes to checking if your calculations were correct.

If you work in finance and you need to do financial reports regularly, your future work will most likely depend on budget dashboards and ease the stress of your everyday work. There are some things that the apps will help you with and you do not need to spend hours wondering whether some payments were made or not.

Sooner or later, we believe that everyone will be using budget dashboards and making the financial part of their business a less stressful job to do.